Table of Content

You’ll must request both a short-term plan, which requires paying your stability in one hundred twenty days, or a long-term plan, which includes monthly payments over more than a hundred and twenty days. When the IRS or a state tax company issues a tax levy on financial institution accounts, your monetary establishment is required to put a hold on the funds in your account. After a 21-day waiting interval, your financial institution has to allow the agency to withdraw enough to cowl your again taxes. As lengthy as the bank levy is in place, your monetary establishment has to permit the agency to proceed to withdraw funds till your again tax quantity is glad.

This type of loan won’t affect your credit since you're primarily borrowing from yourself; interest rates are usually low as properly. The final notice you’ll get before your property are levied is a Notice of Intent to Levy. This notice informs you of your right to request a Collection Due Process listening to. Consider any of those 5 ways to cease an IRS levy and seek the guidance of a tax lawyer to determine which strategy works best in your state of affairs. If the IRS levies your financial institution, funds within the account are held and after 21 days sent to the IRS. However, this does not all the time work – the IRS may be fairly unforgiving when this type of situation develops.

Resolve Your Tax Problems Today!

If you don’t attempt to pay your again taxes, the IRS or your state tax agency can escalate a tax lien right into a tax levy and begin seizing your property. This principally means working fewer hours to manufacture the illusion that you are facing financial hardship. Taxpayers are certified for a streamlined installment settlement if he or she owes $50,000 or less.

When you’re prepared to maneuver forward and get the IRS off your again, reach out to us for a free consultation. We’ll allow you to perceive your options and put an finish to the IRS levy. However, generally, it would take time to get via to the IRS. Like you, so many individuals are attempting to get via to a restricted workers of the IRS.

Make A Case For Economic Hardship

Debbie filed a Chapter 7 bankruptcy case, and it proceeded pretty usually. In addition to eliminating $35,000 of IRS debt, she was also able to wipe out a loan tied to a automotive repossession along with $10,000 in bank card and medical debts. Debbie was quite surprised that the IRS didn't appear at her hearing. It’s potential to instantly stop an IRS financial institution levy or wage garnishment with a bankruptcy filing. In reality, the IRS would be pressured by the Bankruptcy Court to withdraw any present enforcement motion, and the IRS would be required to wait for the Bankruptcy Court to rule on the case. Providing each instant relief and long-term options, tax decision might be the reply you could have been in search of.

You should have also filed and paid on time in the final 5 years. In addition, you should additionally not have had an installment settlement in the earlier 5 years. Finally, you must agree that your installment payments can pay your full steadiness, including interest and penalties, in thirty-six months or less. As lengthy as you follow these guidelines, and comply with file and pay on time for the longer term, the IRS is obligated to conform and set up this cost system for you.

The IRS handles all federal tax levies, while your state tax company usually locations any state levies. In some instances, nevertheless, the IRS can levy your state refund, which suggests the federal company can seize the funds you anticipate to obtain back from your state tax return. For many taxpayers, getting into into aninstallment agreement with the IRS is the most effective method to avoid a levy.

With a levy, you'll receive no prior notice that your funds are about to be frozen. Bank levies are extraordinarily common, and issuing one is a method for the IRS and private creditors to recoup money that they have not been paid. Proving it will instantly release any levy in your assets. You can shield your self from id theft by keeping your social safety quantity personal. This is evidently a dangerous technique, which could have large implications on your spousal relationship.

How Do You Stop A Tax Lien

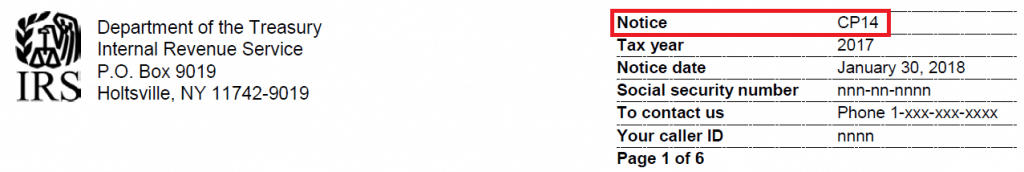

If you pay the quantity in full, together with curiosity and penalties, then the IRS will immediately stop all seizure of property and earnings. The first of these notices known as the NoticeCP14, Status 21. This letter is supposed to inform you that you've got got been assessed for federal tax liability that you owe the IRS, and that you are now a half of a 5 letter sequence .

We also advocate using the IRS’s OIC pre-qualifier on the IRS website to see if you stand a chance of success with this strategy. If the IRS sends you a notice that you simply owe extra taxes than you reported, you simply need to go collectively with them and pay it, right? The IRS has issued a 10-item Taxpayer Bill of Rights, and considered one of them is the right to challenge the IRS’s position. Any particular person is allowed to provide cash gifts up to $14,000 per year with no tax penalties for both the giver or the recipient. Some kinds of retirement accounts permit you to borrow against the policy.

Ways To Cease An Irs Levy

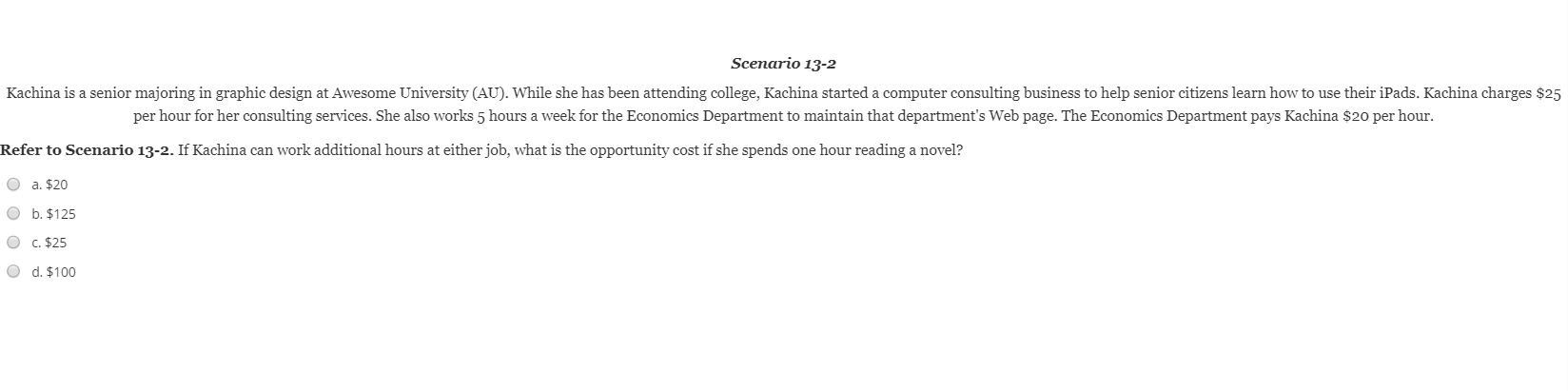

A levy refers to an attempt by the IRS to grab your property to pay for tax debt. Tax levies can embrace penalties such as wage garnishment or the seizure of assets and bank accounts. When you can’t pay all of your tax bill at once, you could possibly arrange a fee plan so you presumably can pay over time and avoid a tax levy. To request an installment agreement, use theIRS on-line payment agreement toolor submitIRS Form 9465.

If a tax levy has triggered serious monetary misery for your beloved ones, you might find a way to apply to have the levy launched. Call the cellphone quantity on the discover to elucidate your circumstances and learn about your choices. The IRS could recommend a payment plan or other strategies to resolve your tax levy. The most effective way to keep away from a tax levy altogether is to file all tax returns on or earlier than the due date. When you meet all IRS and state tax company deadlines, you’re much much less prone to receive penalties and other antagonistic actions like tax levies.

However, just as the installment listed above, there are different criteria. For occasion, you have to have the power to repay the balance in seventy-two months or less. You should also comply with file your whole taxes, including late recordsdata, and that you'll pay your taxes henceforth. This settlement is part of the “Fresh Start Program” instituted by the IRS, which lifted the required amount owed from $25,000 to allow extra probabilities for individuals who owe extra. The notice is actually a name to motion for you to reply by either paying your excellent stability or reply with another viable possibility that the IRS will think about.

To get started, you should submit financial info to the IRS. It will use this data to determine the size of month-to-month cost you are in a position to make. If you’re coping with a tax levy associated to a enterprise tax filing,Enterprise Consultants Groupcan help. This agency handles a broad range of tax and small enterprise issues, and its tax attorneys and EAs concentrate on business tax matters. Whether you need a suggestion in compromise, an installment agreement, or criminal tax protection, Enterprise Consultants Group can help you find an environment friendly resolution. When you receive an IRS tax levy notice, resist the temptation to panic.

How Do I Battle The Irs?

If you don’t pay, the IRS can issue a “Final Notice of Intent to Levy” which provides 30 days to request a hearing. If you don't pay and don't request a hearing, the IRS will problem the IRS levy. This signifies that the IRS’ attempts to collect your back taxes would result in an undue hardship, as you'll be unable to meet basic living expenses. To qualify for CNC, you must submit detailed monetary information to the IRS. Keep in thoughts that this standing shall be reviewed yearly or two.

No comments:

Post a Comment